Overview

You can create a rule to place a declaration statement which you specify on the customs invoice. You can apply this statement to the invoice under certain conditions which you define.

Example Use Case - Preferential Origin Statement GB - EU / EU - GB

As per the trade agreement between GB & EU a statement of preferential origin needs to be supplied on

the customs invoice to benefit from the free trade deal in certain situations.

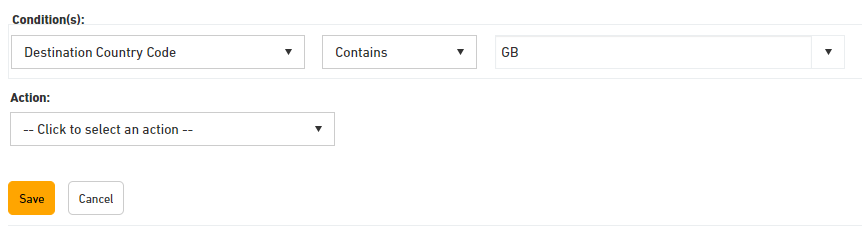

1. Set the first condition

- Go to Settings > Rule > + Add a new Rule

- Use the dropdown menu to set the condition "Destination Country Code" Is "GB"

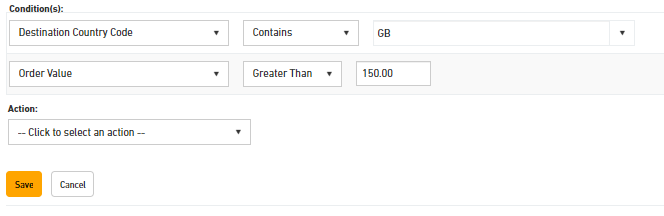

2. Set the second condition. (Optional)

- Click on +Add Another Condition to this rule.

- Use the dropdown menu to set the second condition e.g. if the Destination Country Code Contains GB AND if the Order Value is Greater Than €150.00

Note: You can repeat this action multiple times to add more conditions.

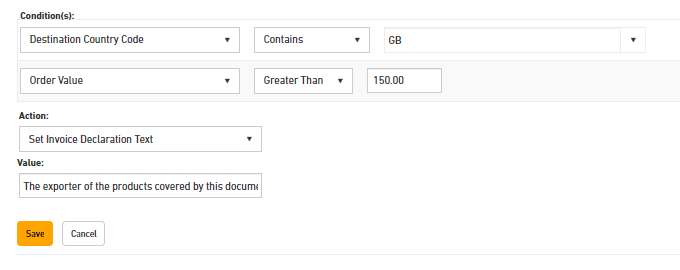

3. Set the action

- Select the Action "Set Invoice Declaration Text" using the drop-down menu

- Input the declaration below with the details populated into the Value field e.g. EORI and Company Name

- Click Save Changes.

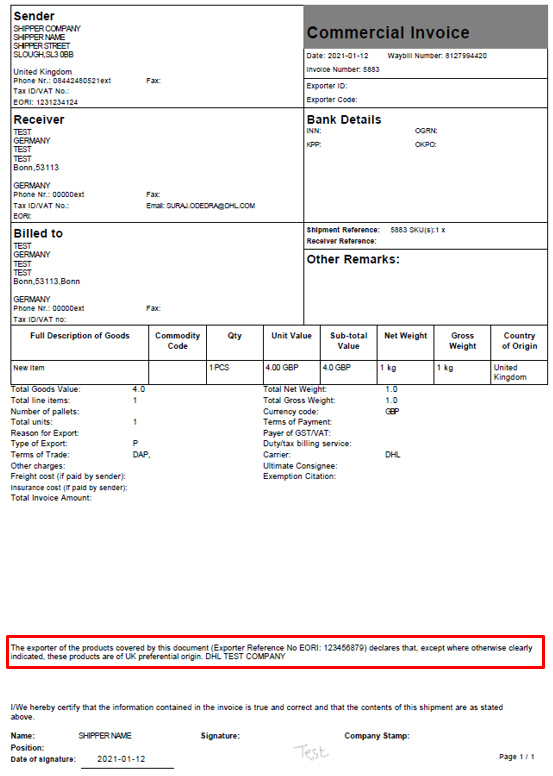

The exporter of the products covered by this document (Exporter Reference No ...) declares that, except where otherwise clearly indicated, these products are of ... preferential origin. (Name of the exporter)

The declaration will now be visible on the customs invoice if the conditions were met which you have defined. Sample below.